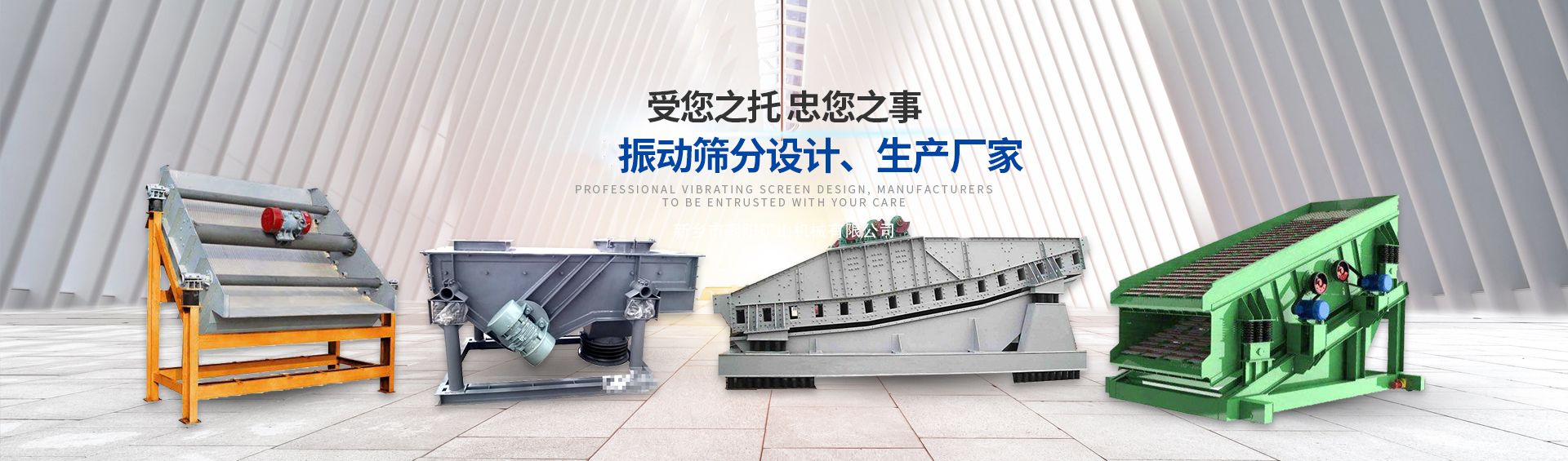

歡迎進(jìn)入新鄉(xiāng)市朝陽(yáng)礦山機(jī)械有限公司官網(wǎng)!

about us

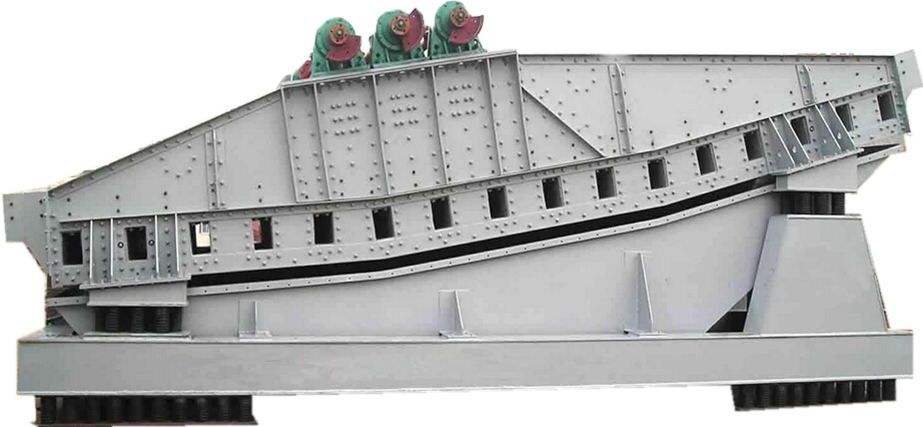

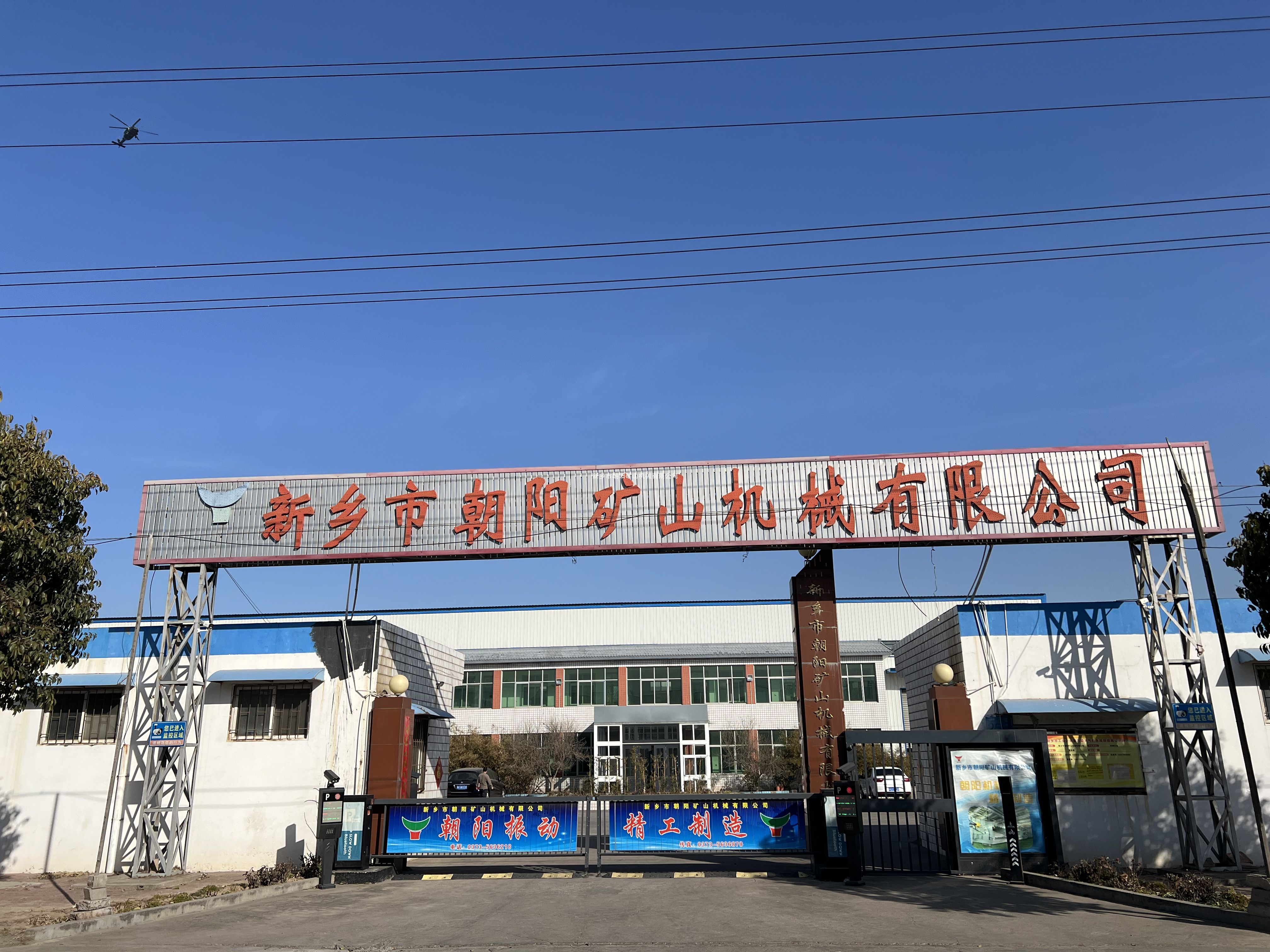

新鄉(xiāng)市朝陽(yáng)礦山機(jī)械有限公司(原新鄉(xiāng)市朝陽(yáng)振動(dòng)機(jī)械廠(chǎng)),地處中原寶地,北依太行,南臨黃河,東有京珠高速,西靠京廣鐵路,座落于新鄉(xiāng)市高新技術(shù)開(kāi)發(fā)區(qū)翟坡鎮(zhèn)。公司是從事冶金礦山設(shè)備的**生產(chǎn)廠(chǎng)家,擁有大型剪板機(jī)、大型折彎?rùn)C(jī)、鍛壓設(shè)備、加工機(jī)床、起重設(shè)備、冷鉚設(shè)備等加工設(shè)備,擁有計(jì)算機(jī)、振動(dòng)參數(shù)測(cè)試臺(tái)等**設(shè)計(jì)及檢測(cè)設(shè)備。多年來(lái),公司本著“**的技術(shù)、**的質(zhì)量、**的服務(wù)”的企業(yè)宗旨,先后與國(guó)內(nèi)**各大鋼......

查看詳情

Why choose us?

![]()

**冶金礦山設(shè)備**生產(chǎn)廠(chǎng)家

擁有大型剪板機(jī)、大型折彎?rùn)C(jī)、鍛壓設(shè)備、加工機(jī)床,擁有計(jì)算機(jī)、振動(dòng)參數(shù)測(cè)試臺(tái)等**設(shè)計(jì)及檢測(cè)設(shè)備。

強(qiáng)強(qiáng)合作 不斷研發(fā)進(jìn)步

先后與國(guó)內(nèi)著名各大鋼鐵院校、冶金設(shè)計(jì)院、煤炭設(shè)計(jì)院、電力設(shè)計(jì)院等學(xué)術(shù)單位建立了密切的技術(shù)協(xié)作關(guān)系,不斷開(kāi)發(fā)研制**技術(shù)產(chǎn)品。

應(yīng)用廣泛 遠(yuǎn)銷(xiāo)多個(gè)省市

生產(chǎn)各種用于冶金、煤炭、焦化、礦山、電力等行業(yè)設(shè)備,深受用戶(hù)信賴(lài)及好評(píng),產(chǎn)品覆蓋國(guó)內(nèi)30多個(gè)省、市、自治區(qū)。

誠(chéng)信經(jīng)營(yíng) 服務(wù)用戶(hù)社會(huì)

以良好的信譽(yù)和高質(zhì)量的產(chǎn)品,服務(wù)于用戶(hù)和社會(huì),在競(jìng)爭(zhēng)激烈的市場(chǎng)經(jīng)濟(jì)大潮中“腳踏實(shí)地、穩(wěn)扎穩(wěn)打”,“振動(dòng)天地、創(chuàng)造輝煌”。

Cooperation case

news center

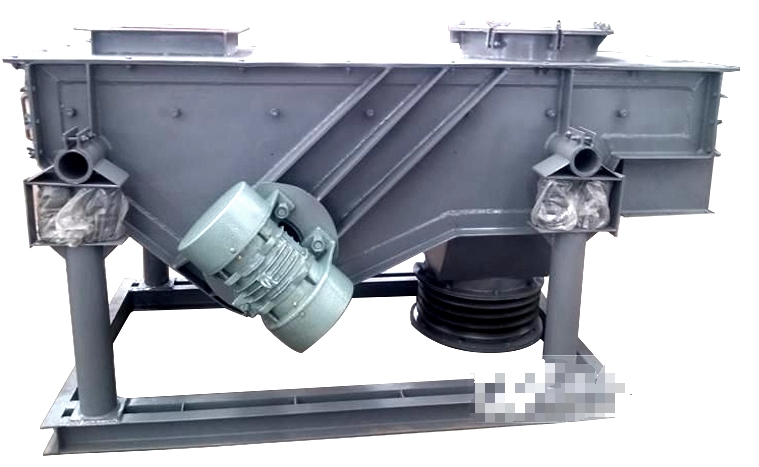

CYS系列直線(xiàn)振動(dòng)篩使用說(shuō)明書(shū)

u 振動(dòng)篩安裝前,要檢查零部件是否完好﹑齊全﹑并對(duì)篩機(jī)安裝基礎(chǔ)進(jìn)行全面清理和檢查。u 振動(dòng)篩整體安裝

查看詳情

30

2020-04

直線(xiàn)振動(dòng)篩有時(shí)會(huì)選擇木制網(wǎng)架以減輕篩機(jī)參振重量, 更換屏幕網(wǎng)很方便。 直線(xiàn)振動(dòng)篩還可以添加彈跳球以提高凈穿透率并有效防止

30

2020-04

雖然振動(dòng)篩分設(shè) 備的種類(lèi)比較多,但是不同的振動(dòng)篩的特點(diǎn)和用途也有差異,所以在選擇振動(dòng)篩時(shí),只要根據(jù)自己的篩分需求選擇合適